The fascinating, rapidly-developing cryptocurrency market has attracted millions of new users with innovation and new financial freedoms.

Solana blockchain combines high performance, scalability, low-cost and high user activity. But that success can also attract bad actors.

There are a variety ofscenarios where tokens (“coins”) are legitimate and popular with loyal fans, and, other cases where the token is a total scam.

How can we tell the difference between good and bad tokens on Solana?

There is no 100% guarantee of predicting in advance a quality token, coin, memecoin or a complete scam. Memecoins, created easily for community-building and trading cultural currency, can be used by scammers… and so can other tokens even for apps. However, we can gain confidence in our research with this article’s checklist.

In this article we’ll discuss and present some options to better inform yourself and research specific tokens on Solana. This article is aimed at the entry/intermediate-level user. I have touched on some more advanced concepts too, but not in too much detail or code.

This article updated March 26, 2025 with Jupiter verify and small edits.

Disclaimer: This is not financial advice. It’s a starter list of ideas/methods to research for quality tokens to learn more about the topic. But these alone do not guarantee good token quality, and cannot prevent losing money. There are other factors not covered here, such as unique market conditions, team, other variables, unknowns. Buying/selling tokens is inherently highly risky, and people often lose all their investment. This is not a recommendation to participate, trade or invest in any specific token or to even trade at all. Only invest money if you can afford the high risk and high possibility of losing it.

Lastly, this article may be updated with new info as received, it is a work in progress. I wanted to publish quickly, to give at least some info out ASAP to help people who need it now. Last Updated: Feb 19, 2025.

“PRIORITY”. I’ve categorized these “red flags” by level of importance:

- VERY HIGH: Highly correlated to flawed tokens & losses.

- HIGH: A strong warning signal, often associated with bad quality.

- MEDIUM: Indicator of possible trouble. Not necessarily an issue but in some cases could be a sign of bad quality.

These indications are meant to be cumulative. In other words, the more red flags, the more it correlates to a poor quality token you should avoid.

Here are some red flags to check when thinking of buying a token:

1. Launch Date and Longevity Risk

- ❌ Token launched in the last 72 hours.

- ❌ Token launched within the last week.

- ❌ Token is not Jupiter “verified”.

2. Tokenomics, Ownership Risk.

- ❌ Highly concentrated ownership.

- ❌ Small number of wallets hold all supply.

- ❌ Mostly new wallets for initial holders created within 72 hours before launch.

- ❌ Percentage owned by top 10 holders is more than 20%.

- ❌ High inflation rate diluting value.

- ❌ Opaque tokenomics design.

- ❌ High amount of initial supply to VC firms, minimal to community.

- ❌ Percentage of liquidity pool burned or locked is less than 50%.

- ❌ Unclear vesting schedules.

- ❌ Excessively high total supply.

- ❌ Disproportionate pre-sale allocations.

- ❌ Hidden or ambiguous fee structures.

- ❌ Overly generous reward mechanisms.

- ❌ Frequent changes to tokenomics parameters.

- ❌ Lack of deflationary measures.

3. Solana Token & Extension Configurations.

- ❌ Mint Authority NOT disabled (should be disabled):

- ❌ Freeze Authority NOT disabled (should be disabled): Developer’s can freeze transactions

- ❌ Developer’s can freeze transactions.

- ❌ Program/Contract ownership not renounced, modifiability risk.

- ❌ Upgradeable token features.

- ❌ Transferability should be on.

- ❌ External call (should not be on).

- ❌ Multisig control and authority issues.

- ❌ Transfer fee extension is on (should not be). Buy/Sell tax.

- ❌ Using many extensions may create more security issue surface area.

4. Team Risk.

- ❌ Team/dev/member is not doxxed.

- ❌ Team are totally unknown with no past track record.

- ❌ Developer mints is very high or over 50.

- ❌ Advisors: Team has no known/doxxed advisors.

5. Governance Risk.

- ❌ No formal governance process or DAO.

- ❌ There is governance, but only a few users control it.

- ❌ No decentralized governance methods.

- ❌ Lack of transparency of the governance process.

- ❌ No community input or oversight mechanism.

6. Token audit (program aka “smart contract”)

- ❌ Token has not been audited through automated auditing.

- ❌ Token was not audited through MANUAL auditing.

- ❌ Token flagged as possible “honeypot”.

7. Community engagement.

- ❌ Community trust score low.

- ❌ Less than 2 social media accounts.

- ❌ No website.

- ❌ No way to contact the team.

- ❌ Infrequent community updates.

- ❌ Possible hacked social media shares CA.

- ❌ High number of KOLs suddenly promoting.

8. Partnerships and backing

- ❌ Unverified partnerships.

- ❌ Self-proclaimed endorsements.

- ❌ Partnerships with obscure entities.

- ❌ Inconsistent partnership communication.

- ❌ Last-minute partnership announcements.

9. Roadmap clarity.

- ❌ Vague milestones.

- ❌ Overly ambitious timelines.

- ❌ No measurable metrics.

10. Utility and use cases.

- ❌ No clear token purpose other than sentiment and hype.

- ❌ Undefined use cases, poorly explained.

- ❌ Overly complex justifications.

11. Market liquidity.

- ❌ Low liquidity on major Solana DEXs.

- ❌ Rapid liquidity withdrawals.

- ❌ Concentrated liquidity provision.

- ❌ Illiquid trading pairs.

12. Tools Available

- ✅ Tokensniffer

- ✅ Rugcheck

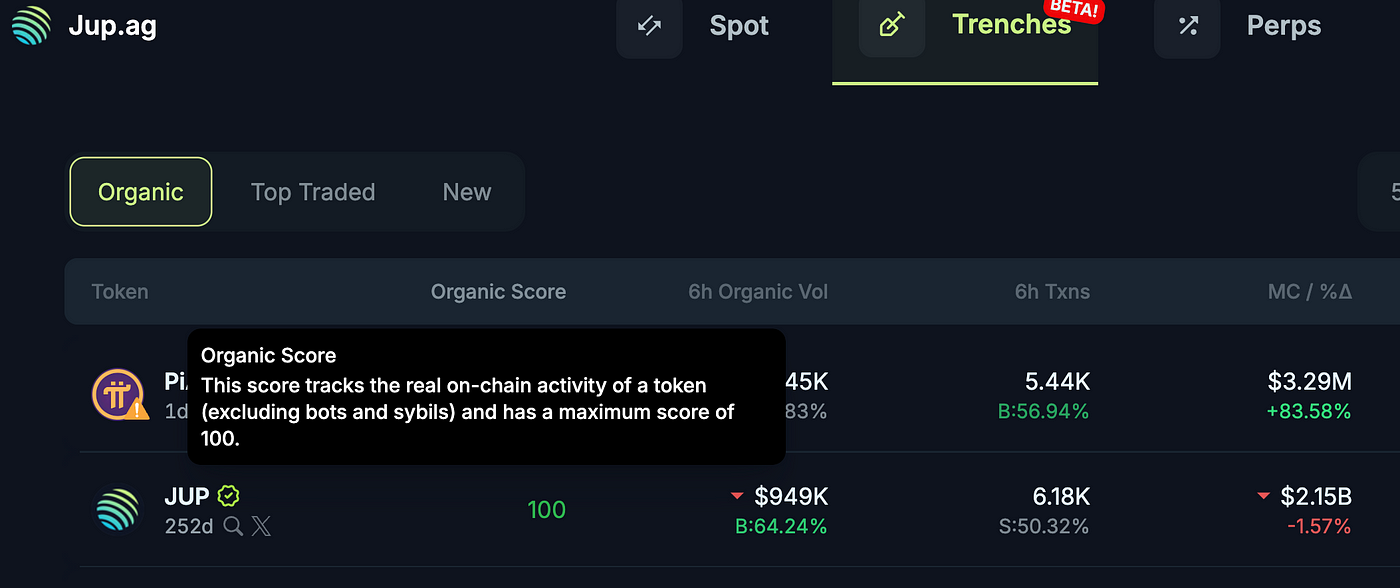

- ✅ Jupiter Trenches Organic Score

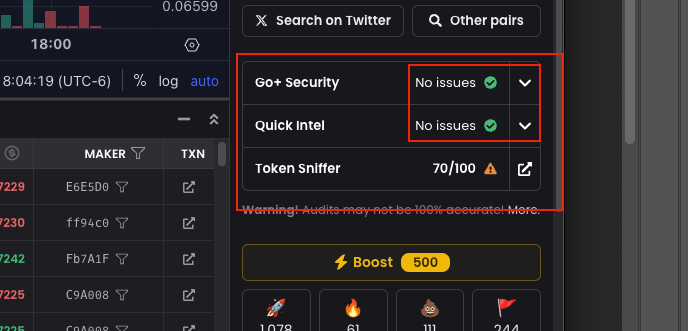

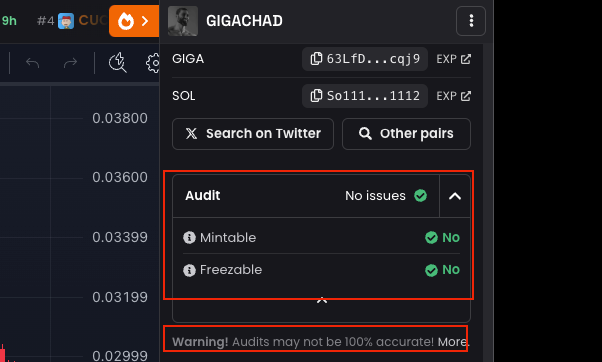

- ✅ Dexscreener: Audit, Mintable, Freezable

- ✅ Bubblemaps

🥰 Thanks for reading! … 🔥 please clap and share this article, thanks! 🚀

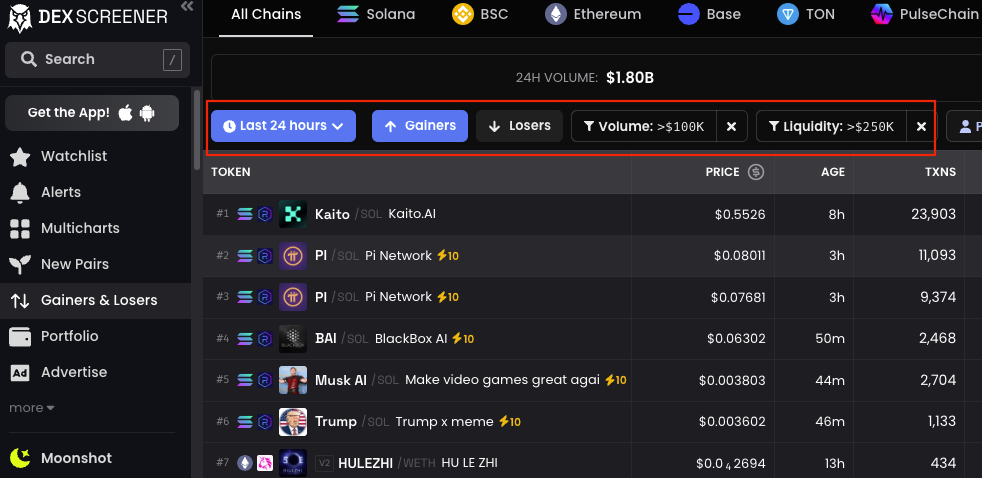

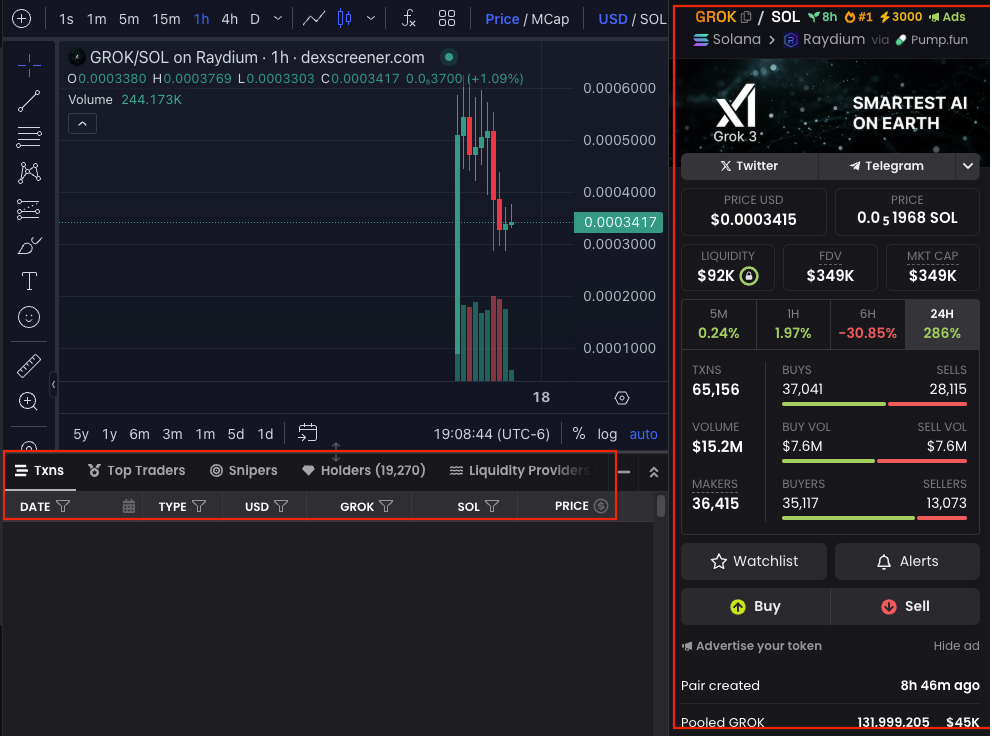

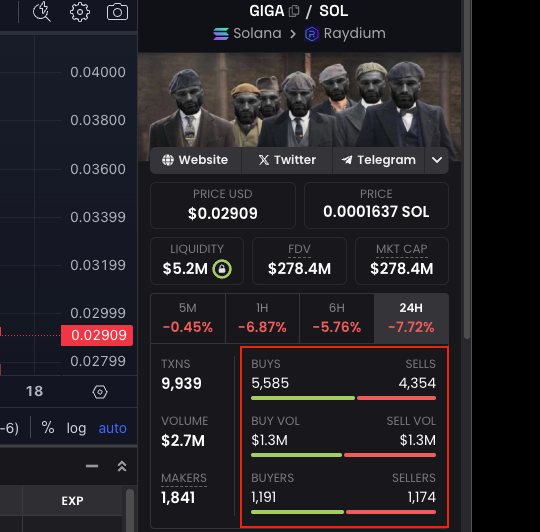

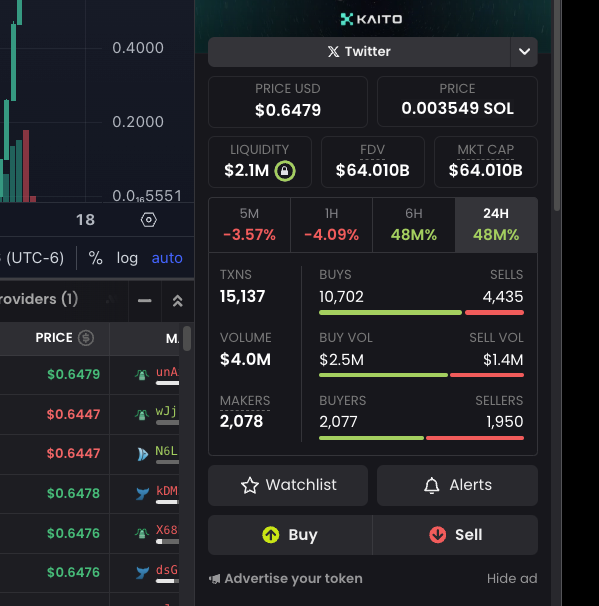

For many examples I use Dexscreener.com because I am most familiar with it and it shows a great variety of data. There are other tools you can also use which I covered both in the Tools section below and also in my last memecoins article.

Dexscreener has the token page and browsing pages. On both you can use filters and tabs.

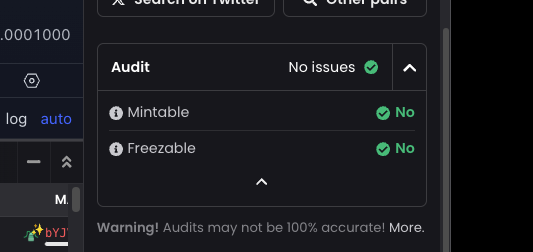

See details with Automated Security audits available on some (but not all) coins in Dexscreener.com:

1. Launch Date and Longevity Risk

The riskiest time to buy a token is when it is first launched.

In the first days and week after launch there is often little or no track record. The team, community, governance or roadmap of the project and other info could turn out to be false and a scam after several days.

Only after the project has attained a track record after weeks, months and longer, do we gain confidence in it’s legitimacy. More time gives us the ability to assess if the team was honest, the tokenomics, governance and other follow-through.

❌ Token launched in the last 72 hours. Probably 95% of new tokens (estimated) never regain the high price they achieved in this 72 hr. window of time at launch. If you are buying here, it highly likely to be near the top and you will lose money. Good idea to wait. Priority: VERY HIGH.

❌ Token launched within the last week. Many (*but not all) “rugs” are done within the first week. Most scammers are trying to profit off a scam as soon as possible, because that’s less effort on their part to keep the momentum/price high. They cash out money quickly and move on to the next one. Of course, there are exceptions (longer-term), but beware of the first week. Priority: HIGH.

✅ Nice to have: A more mature token over 1 month or more. A mature token that has steadily increased in positive metrics over a long period of time, over months, helps us get a track record that the team has been transparent, honest and trustworthy. We can gather more research with more time. It helps us see price trends. For example, a steadily growing community, holders and price shows consistency. A new token in the last few days lack all of that.

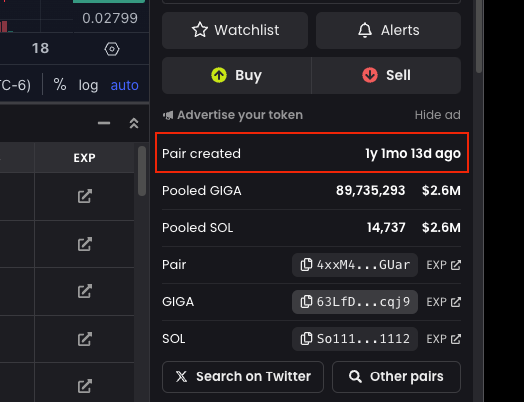

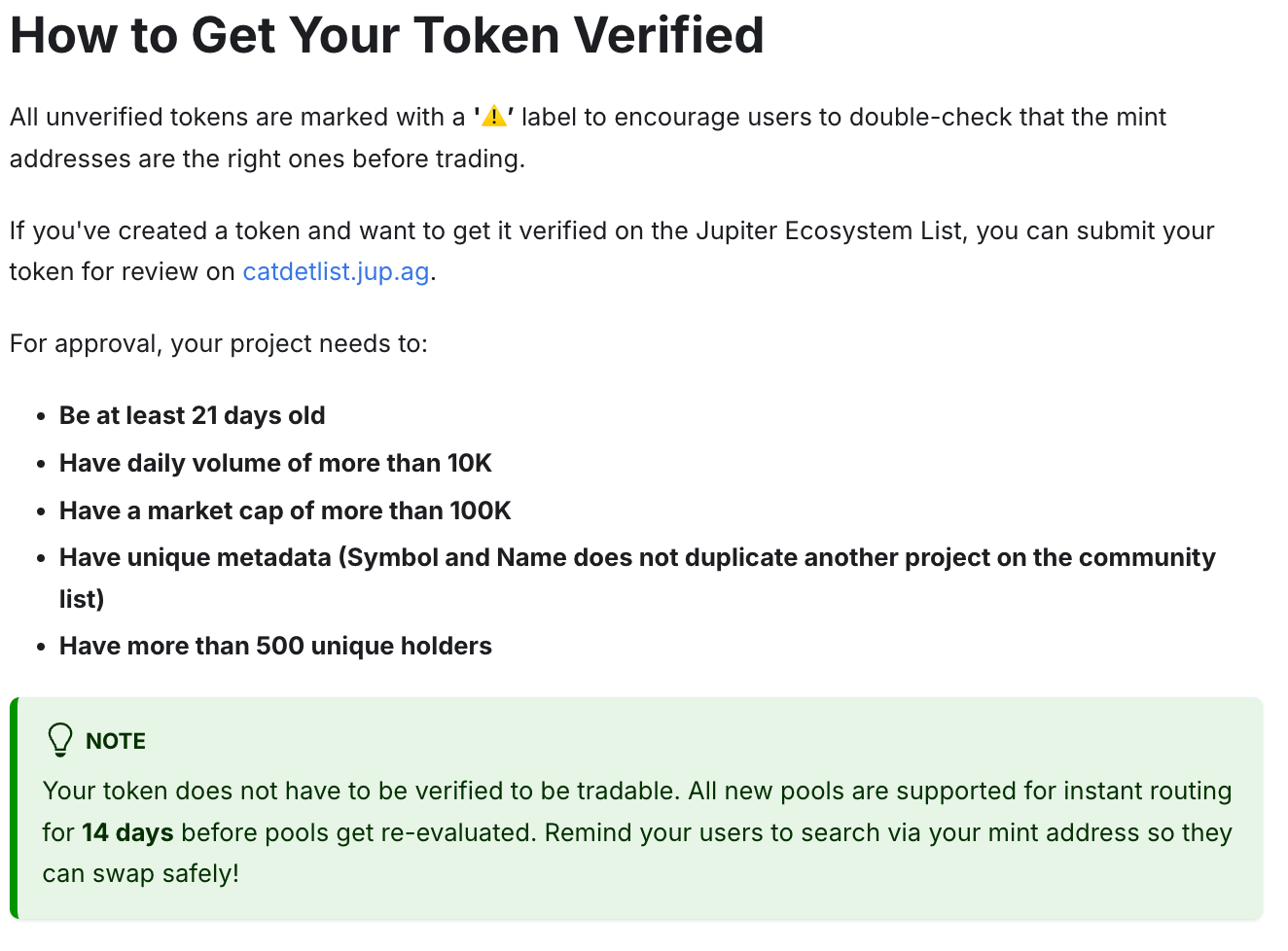

❌ Token is not Jupiter “verified”. Jupiter verified is a process where Jupiter attaches the label “Verified” to tokens meeting specific criteria (see image below).

This verification list is maintained by the Jupiter dex. One reason for this is to prevent similar token names from confusing users. Note: it is not verification of the suitability, risk or quality of the token… only that they did submit the token for inclusion in Jupiter’s program and met their criteria. ⚠️ This is an indicator, but verified, by itself, does not prove quality. Priority: MEDIUM-HIGH.

Waiting a few days from launch helps avoid buying tops, scams and may help better trades. For example, though $TRUMP fell from it’s high, a few weeks later we saw several buy opportunities where 30% profits could have been made in 1–2 day periods.

Also for actual scams, most are run and done in the first week, so I suspect you can avoid many even if you did not read the rest of this article.

🚀 Jupiter on March 26, 2025, release some new token verification metrics: https://verify.jup.ag/

- Jupiter Verify aims to provide clear token verification standards to boost community trust. It also allows projects to demonstrate confidence and legitimacy.

- This is the third major iteration of their token list system, built over three years. It marks the first time standards are being clearly defined.

- Blue Chip. Designed for tokens already well-established in the ecosystem. Tokens must maintain a $100M market cap and high volume for a month. Qualifying tokens will be manually reviewed and added. Examples include USDC, JUP, and WIF.

- Community Assisted. Aimed at emerging tokens showing strong community and market traction. Evaluation considers market cap, liquidity, volume, and engagement signals like “smart likes.” Eligible tokens are reviewed manually, with up to 1–3 approved daily based on market conditions. Tokens may also be considered if they miss thresholds but have strong ecosystem recognition.

- Social ID Verification. Projects can link their token to a known social account to prove ownership. Only famous or well-known accounts qualify.

- C.A.T Prelaunch Report. Aimed at reducing launch uncertainty by clarifying token supply, stakeholder alignment, and transparency. This is an experimental manual of best practices reviewed before a token launch.

2. Tokenomics, Ownership Risk.

Examine the token’s distribution, total supply, and inflation mechanisms to identify any imbalances that might indicate a potential scam.

This is worth diving into, but may be a slightly more complex part of this article. Stick with it!

You can examine tokenomics onchain and this will give you some redflags if they exist:

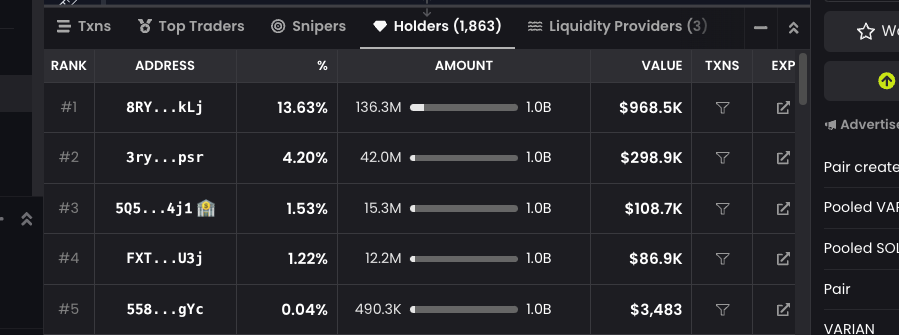

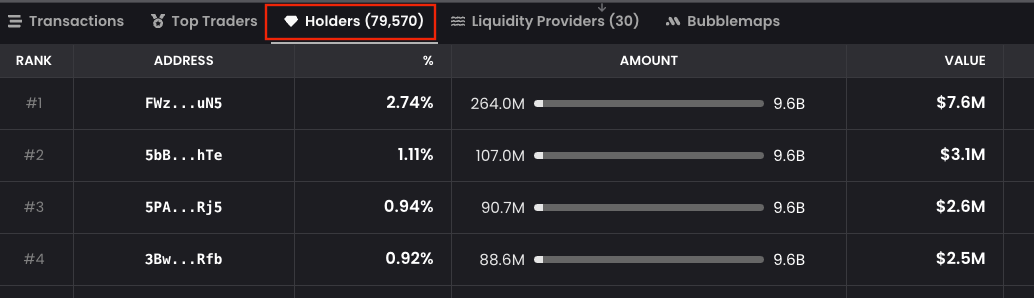

❌ Highly Concentrated ownership. If a project reveals that a large percentage of the tokens, for example 70%+ are controlled by a handful of insiders at launch, it may lead to price manipulation and increased risk for regular investors. It they all sold at once the price could tank, leaving others at a loss. Priority: VERY HIGH.

❌ Small number of wallets hold all supply. Small number of wallets hold over 50% of the total token supply. Can easily dump on smaller users Priority: VERY HIGH.

❌ Mostly new wallets for initial holders created within 72 hours before launch. This is common even with more legit new launches, but ideally you will have known wallets, wallets of known users or doxxed wallets/people. They will have been made well prior to the launch. In itself it’s a warning sign to be aware of, but not always an issue. PRIORITY: Medium

❌ Percentage owned by top 10 holders is more than 20%. Even if many wallets are owning, and not original investors, you should still make sure that the 10 wallets do not concentrate holdings. Again, they could sell at any time causing the price to dump. PRIORITY: HIGH

✅ Nice to have: High diversity of wallets. Good to see many wallets that are trading normally (not bots) and include well-known/doxxed traders who have been reliable, honest and a have viewable record of activity in the past.

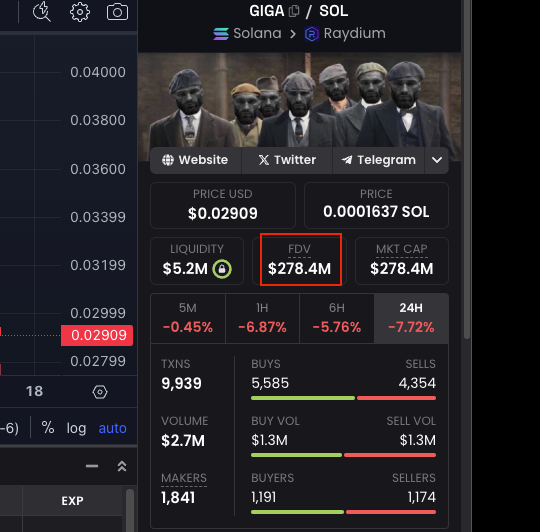

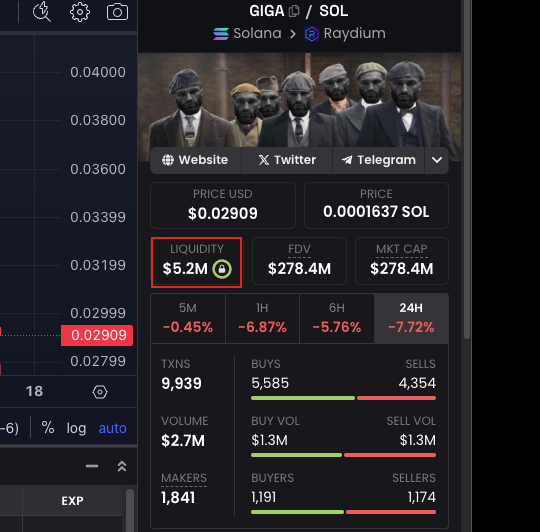

❌ High inflation rate diluting value. Keep an eye on FDV (fully diluted value) number as shown on DEXs. If the FDV is vastly higher than the current market cap, it signals that if all tokens are eventually minted, the token’s value could be significantly diluted. If new tokens can be minted continuously at a fast pace, this can dilute the value of existing tokens, making it hard for holders to see any real gains. FDV = (total supply — burned supply) * price… Priority: VERY HIGH.

✅ Nice to have: Inflation control. Ideally there will be a well-planned inflation mechanism that releases new tokens at a controlled, predictable pace. This means token supply increases slowly enough so that existing token holders do not see their holdings diluted unexpectedly.

❌ Opaque tokenomics design. For example, if details about token distribution and supply changes are missing or vague in official documentation, it can indicate that the project isn’t fully transparent about its economic model. Priority: VERY HIGH.

❌ High amount of initial supply to VC firms, minimal to community. A token sale/launch where nearly all tokens are pre-assigned to venture capital firms and private investors, with minimal allocation to community members. This imbalance could result in these large holders having excessive influence over the market, possibly engaging in coordinated actions to dump, harming others. Priority: HIGH.

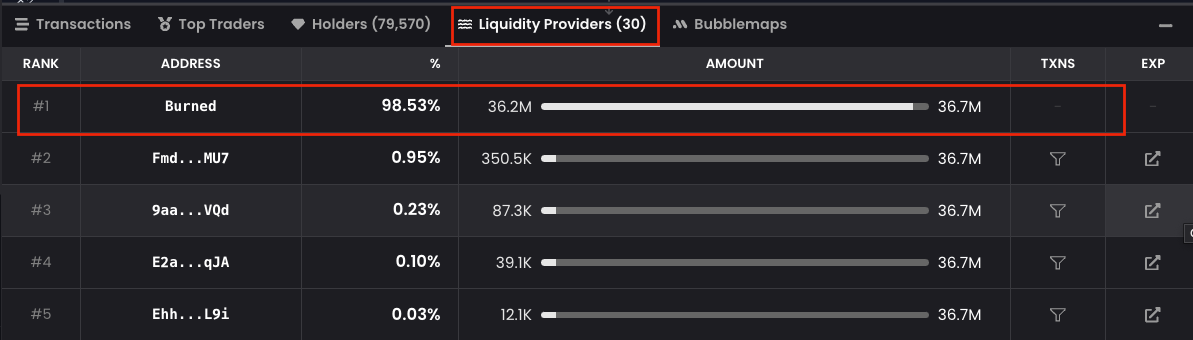

❌ %of liquidity pool burned or locked is less than 50%. When more than half of the liquidity pool tokens are burned or locked for a token, it signals that the developers cannot easily withdraw funds. More than 50% is ideal according to Jupiter DEX. A liquidity pool is a collection of funds — typically pairs of tokens — locked in a Solana onchain program usually before/at launch. It provides the necessary tokens for trading on DEXs, so if people want to trade they can do so immediately using the pool rather than waiting for a matching order.

❌ Unclear vesting schedules. For example, if team tokens are initially locked, but are released without a clearly defined vesting period, founders might sell their tokens immediately, leading to sudden market dumps. If a token has been locked, then you should be able to find out the time amount of the lock and release date. Priority: HIGH.

❌ Excessively high total supply. For example, a token with an enormous total supply may dilute value so much that even large purchases have little impact on price, reducing the token’s overall worth. With so many tokens in circulation, the perceived scarcity is lost. Note that some legit, successful memecoins like BONK do have high supplies, so it’s not an automatic negative. Priority: MEDIUM.

❌ Disproportionate pre-sale allocations. Early investors receive a significantly larger share of tokens compared to what is available to the public, it may signal an intention to offload tokens quickly for profit. Priority: MEDIUM.

❌ Hidden or ambiguous fee structures. For example, if the tokenomics section doesn’t clearly explain transaction fees or redistribution mechanisms, users might be caught off guard by unexpected deductions. Priority: MEDIUM.

❌ Overly generous reward mechanisms. For example, if a project promises extremely high staking rewards without a sustainable model, it may be a sign of a pump-and-dump scheme rather than genuine value creation. Priority: MEDIUM.

❌ Frequent changes to tokenomics parameters. For example, if the project’s team regularly alters key elements like inflation rates or distribution rules without community input, it may reflect instability or hidden issues in the project’s planning. Priority: MEDIUM.

✅ Nice to have: Program stability and consistent plans: It’s nice to have tokenomics parameters that don’t change often and, if they do, changes are made through transparent discussions with the community. Consistency builds trust, showing that the team isn’t making last-minute adjustments without thorough consideration.

❌ Lack of deflationary measures. For example, a project that doesn’t include token burn or buyback strategies may struggle to balance inflation, potentially reducing long-term token value. Many projects do not have deflation, and that does not mean they are untrustworthy, but it is an indicator to watch. Priority: MEDIUM.

✅ Nice to have: Deflationary features. It’s great to have strategies like token burns or buybacks in place.

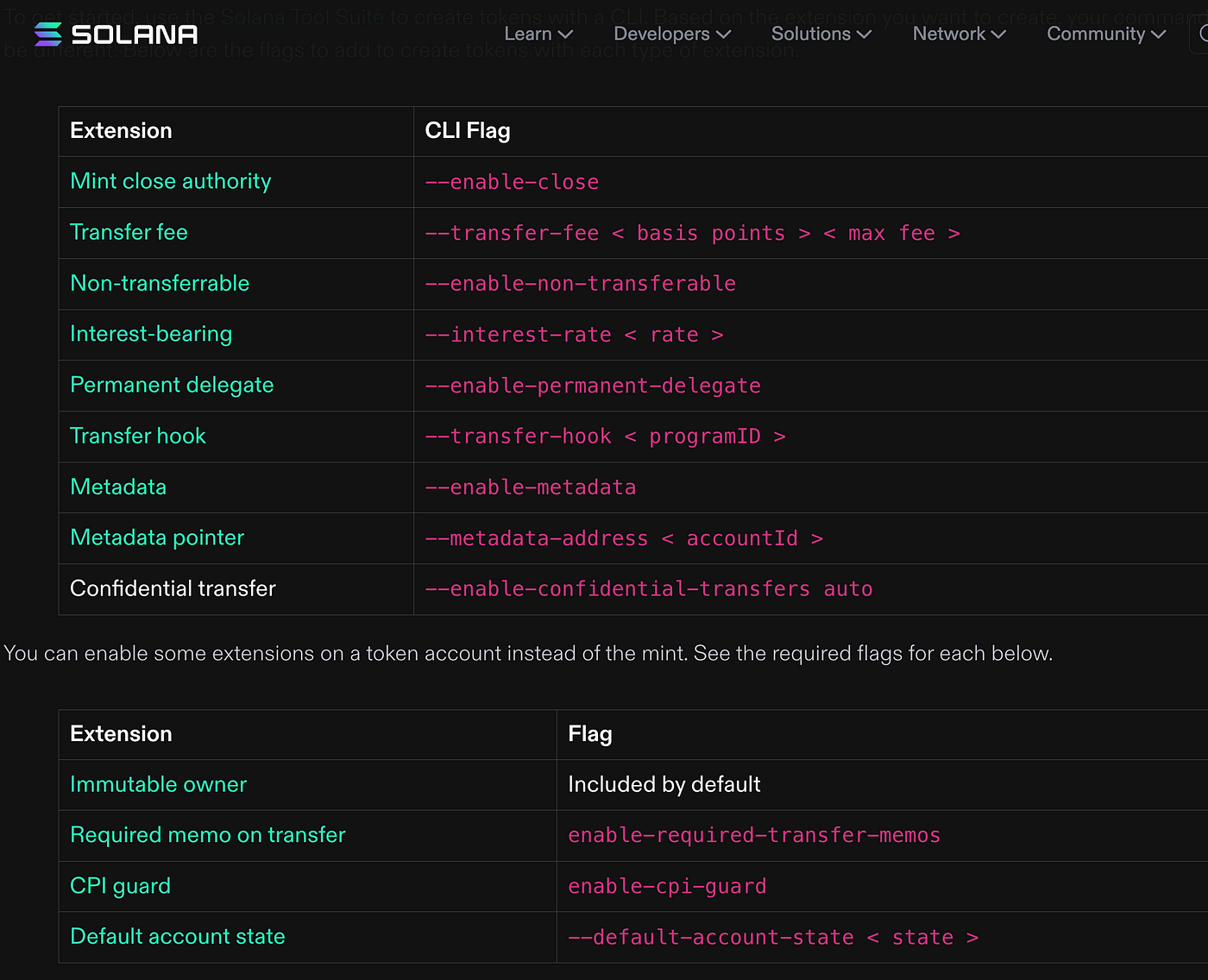

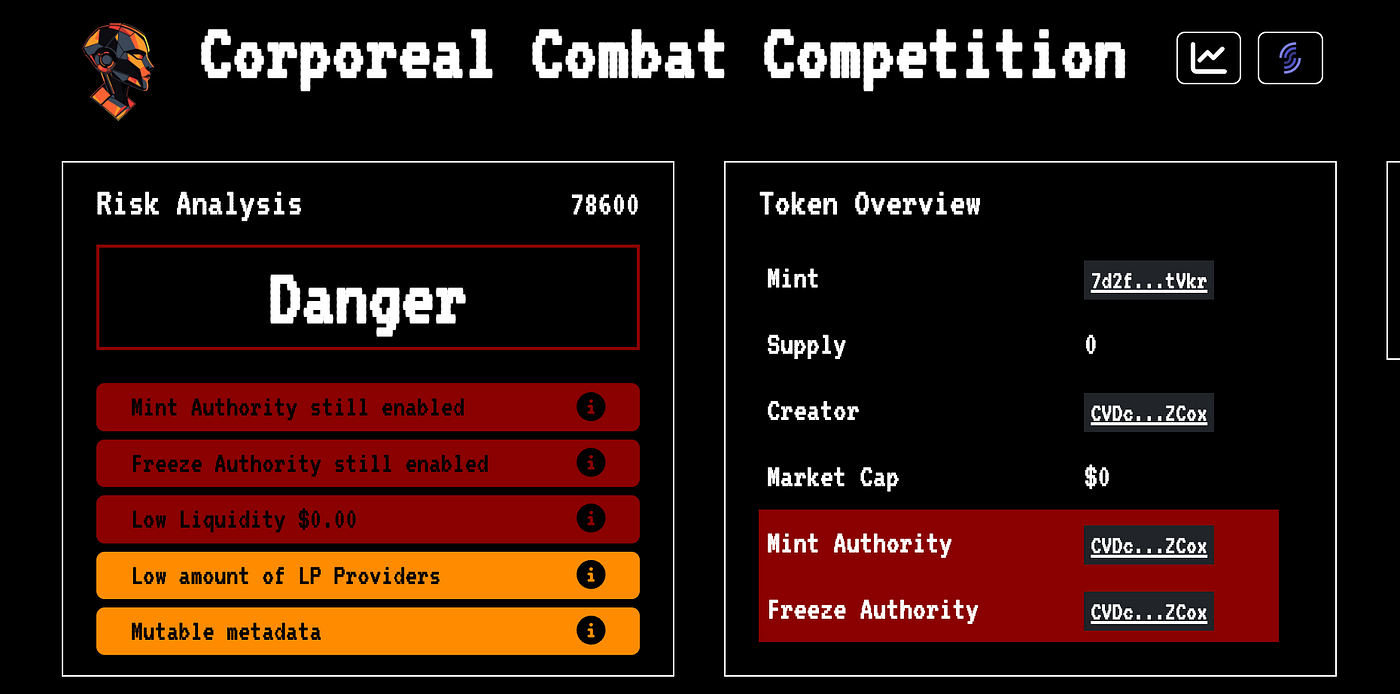

3. Solana Token & Extension Configurations.

There are several Solana tools as part of the token extension creation program that give flexibility to developers to create modifiable tokens. They can be turned off. If on, it allows them flexibility to create new features. Unfortunately, this can also create a risk for investors in some cases.

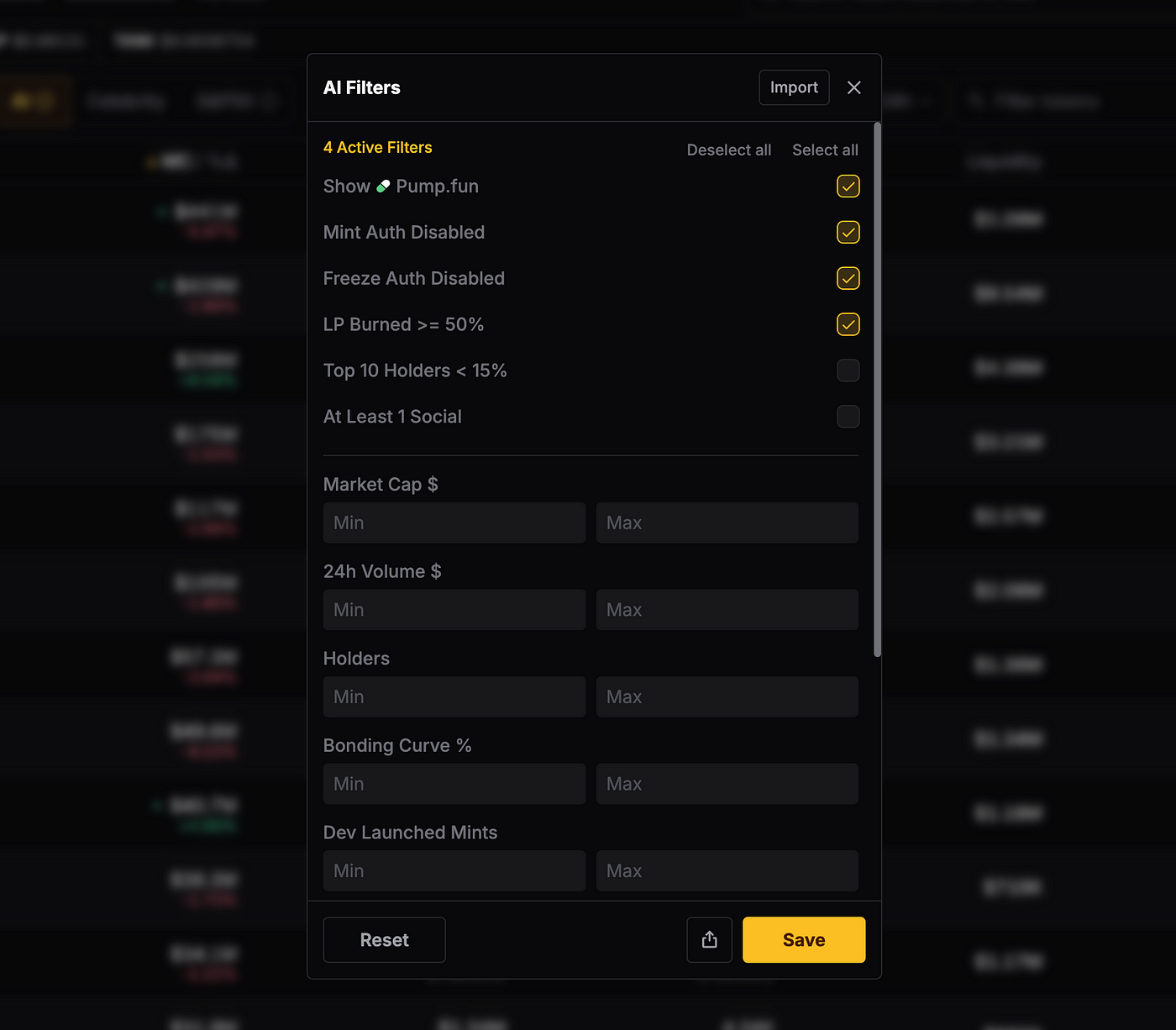

Many DEXs show information about the Mint Authority and Token Extensions, for example this image shows filters is on Jupiter APE (Trenches):

This is a list of Token Extensions that may come into play:

❌ Mint Authority NOT disabled (should be disabled): Ability for devs to mint new tokens. When developers have the ability to mint new tokens at will with no programmatic lock, there is a risk of increasing the total supply unexpectedly. This can lead to inflation and lower the value of tokens held by investors. Priority: VERY HIGH.

❌ Freeze Authority NOT disabled (should be disabled): Developer’s can freeze transactions. When developers can freeze token transactions, it can restrict users’ ability to freely trade or use their tokens. This undermines the decentralized ethos by putting too much power in the hands of the team. If the freeze authority is misused, developers might selectively block or delay transactions. Priority: HIGH.

✅ Nice to have: Mint Authority and Freeze Authority should be disabled,metadata should not be mutable ideallyand other token extensions should be off. Keep in mind the metadata is sometimes left mutable so the dev can make changes to the name, info, image if necessary. But ideally it is not.

❌ Program/Contract ownership not renounced, modifiability risk. Solana token extensions may allow developers to alter key token parameters post-launch, which can be useful for updates but also increases the risk of unexpected changes that might negatively affect token holders. If the the owner has renounced ownership, then this makes it so they cannot change or modify the token. Priority: HIGH.

❌ Upgradeable token features. Tokens designed to be upgradeable through extensions can receive new functionalities or modifications over time; however, without robust governance or community oversight, these upgrades might alter the token’s economic model in ways that could be harmful to investors. Priority: VERY HIGH.

❌ Transferability is not on. Users should be able to transfer tokens. “The NonTransferable extension makes it possible to create tokens that cannot be transferred.” Priority: VERY HIGH.

❌ External call (should not be on). Ideally the external call should not be on. There may be a legitimate use, however it is a security risk. Basically it allows the dev to integrate additionally functionality that the token holder may not be aware of. Priority: HIGH.

❌ Multisig control and authority issues. The control of token authority may appear decentralized with a multisignature (multisig) wallet, but it can still centralize power if it only requires a subset of signers to approve transactions. There may be a shared key (such as using Squads Protocol multisig wallet), but the shared key could be only 2 of 3 for example, which means only two signers are required. This concentration of power can lead to potential abuse, where decisions made by a few can significantly impact the token’s market performance. Priority: HIGH-VERY HIGH.

✅ Nice to have: Multisig control should require a high threshold of consensus, ideally with all key signers required to approve any significant actions, ensuring a balanced distribution of authority. Additional measures, such as periodic audits and transparent governance protocols, can further minimize the risk of abuse or unauthorized changes.

❌ Transfer fee extension is on (should not be). Some extensions enable the imposition of fees on token transfers; this mechanism can fund project development, but arbitrary or excessive fees might reduce liquidity and make trading less attractive for investors. This is sometmies referred to a buy or sell tax, as a fee a placed on transfer. There may be a legitimate reason a dev wants this, but you should know in advance otherwise your buy/sell may have different results than you anticipated. Priority: HIGH.

❌ Using many extensions may create more security issue surface area.Adding many extra layers of functionality through Solana token extensions could increase the complexity of the program, “smart contract” code, which in turn can widen the attack surface for hackers and potentially introduce exploitable bugs. Honestly I don’t have examples of this, so this is more down as an indicator and “in theory” Priority: MEDIUM.

4. Team Risk.

Look for clear, verifiable information about the development team, including their backgrounds and experience in blockchain, to assess reliability.

❌ Team/dev/member is not doxxed. This means that a team is anonymous and their real identity is hidden. Most scam artists for obvious reasons will create false identities or be anonymous. That does not mean all anonymous people are scammers, either. There are good reasons for devs to be anonymous for privacy. Nevertheless, lack public identity for anybody on the team is a red flag. Priority: HIGH.

❌ Team are totally unknown with no past track record. Assess whether the team has a track record of successfully completing previous projects. Experience with prior ventures can indicate their ability to deliver on their promises.

✅ Nice to have: At least one member or more with a public identity, and a public track record. They should have a good track record of token/coin involvement.

❌ Developer mints is very high or over 50. Some sites/apps such as Jupiter APE track number of tokens minted by the developer. Quite honestly I am not 100% at present writing how they derive this, whether it is based on one wallet or a whether they “walk” to connected wallets (possible, some tools do this). However, there is definitely a number in Jupiter APE and I’ve seen them randing from very low like a couple to thousands. Also beware there are some legit coins that have high mints, so its an indicator but not 100% accurate. Priority: HIGH.

❌ Advisors: Team has no known/doxxed advisors. A real project will have reputable advisors involved. If they have none or remain anonymous then that’s could be a red flag. At least it shows that they have not gotten to that phase of development. Priority: MEDIUM.

5. Governance Risk.

Check for transparent, decentralized governance structures that allow community oversight, which can help prevent manipulation by a single party.

Most memecoins when first launched do not have a detailed governance roadmap. Most tokens, even legit ones, are just trying to get some traction. Governance usually comes later after there is enough success at first and then some crisis or conflict.

Nevertheless, these are indicators of risk and maturity of the token, and how well thought-out the project is if they have or have not considered it.

❌ There is no formal governance process or DAO. Decisions could be made arbitrarily by a single individual or a small group, and without oversight, this could lead to poor management or manipulation. The individual may drop out of the project, or if unethical may ruin it. Priority: HIGH.

❌ There is governance, but only a few users control it. This can lead to biased outcomes that do not reflect the interests of the broader community. Such a scenario risks sidelining the input of the majority and can lead to decisions that benefit only those in control. Priority: HIGH.

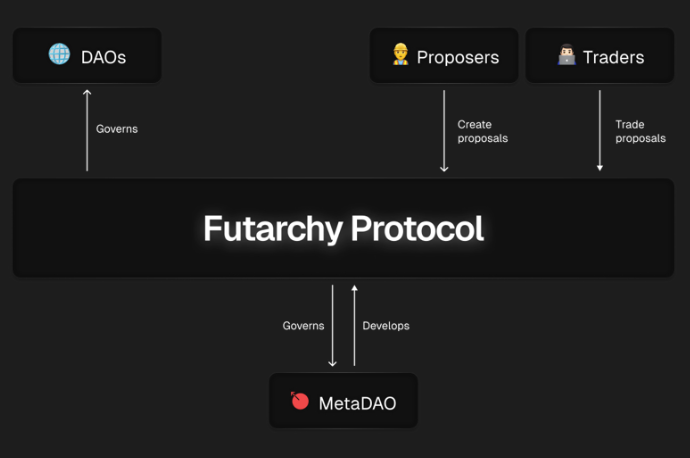

❌ No decentralized governance methods. There are a variety of methods of onchain governance possible. Futarchy such as with the MetaDAO project has been gaining some traction and interest. Another popular choice is Realms: “Realms is a sophisticated, fully on-chain platform designed to simplify and enhance the management of decentralized autonomous organizations (DAOs) on the Solana blockchain.” A quick way to governance involves using Squads and multisignature wallets.

❌ Lack of transparency of the process. Sometimes there is actually process that looks good on paper, but then decisions are made secretively. Therefore, there is no transparency or ways to verify what is actually going on in the process. Priority: HIGH.

❌ There is no community input or oversight mechanism. In other words, perhaps there is a “board of deciders” and it is transparent, but there is no way to have community input into decisions. Priority: MEDIUM.

✅ Nice to have: Look for an explicit governance framework and process spread out among many contributors.

Decentralization Concern: The absence of a decentralized governance structure means that power is likely concentrated in the hands of a few individuals, which can lead to biased decisions that may not benefit the community.

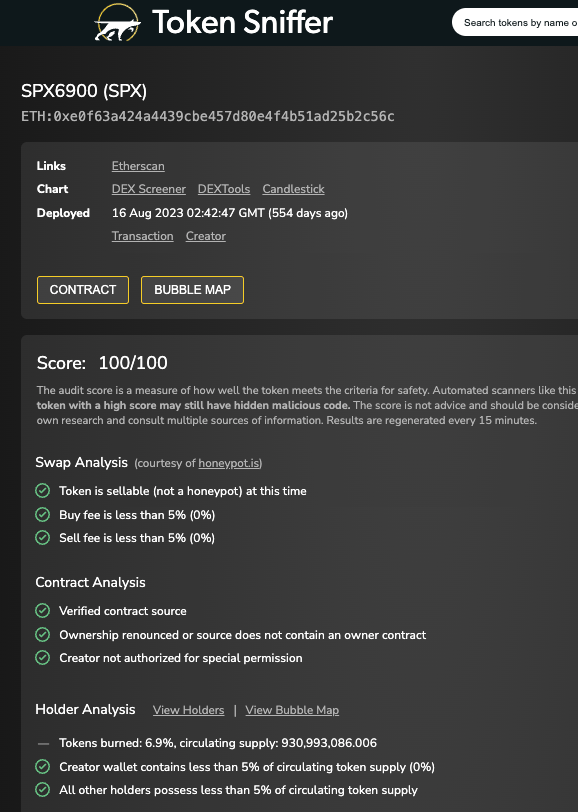

6. Token, program audit.

Verify if the token’s underlying code has been audited by reputable firms to ensure there are no vulnerabilities or hidden backdoors.

❌ Token has not been audited through automated auditing. Some sites use automated checks from 3rd-party entities for common vulnerabilities. These can miss problems though and should only be taken as a high-level pass, not a foolproof method of finding problems. Priority: HIGH.

⚠️ WARNING: An automated audit just looks for obvious factors as a first line of defense, it does not substitute for completelness of a full manual security audit.

❌ Token was not audited through MANUAL auditing. Most tokens in the memecoin space do not get a manual audit. It can be expensive so it’s fairly common for even legit tokens to not get a manual audit. They may some time after they have gained a community and price appreciation. However, it should be pursued to find any possible flaws and security issues. Priority: MEDIUM.

Ottersec is one of the well-known token, program and smart contract audit firms that can help validate a program is secure.

❌ Token flagged as possible “honeypot”. Automate security audits may flag a token as a security risk and honeypot if it exhibits a number of factors whiche concern in the audit, such as external function calls, malicious code or code that cannot be understood in the scan. Priority: HIGH.

7. Community engagement.

Observe the quality and consistency of community interactions and updates, as an active, open community is often a positive sign.

❌ Community trust score low. Many dexes and coin websites allow users to rate the coin. If there are a lot of votes that indicate poor quality, then this could be a big warning sign. Note that if there are onbly a few votes or if malicious reviews are being made, this may skew the results one way or the other, so this is not always credible. Priority: MEDIUM.

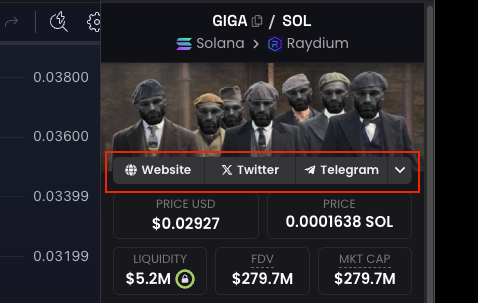

❌ Less than 2 Social Media accounts. Social media like X, Discord, Telegram, or forums are vital for direct engagement and support. Most serious startups and memecoins will have multiple social media accounts to build and support their community. If a project lacks diversity in its online presence, it’s likely not committed to transparent communication. Priority: VERY HIGH.

❌ No website. A basic, informational website is essential for a project. Without one, it suggests a lack of professionalism and seriousness, potentially indicating a pump-and-dump scheme. Priority: VERY HIGH.

❌ No way to contact the team. Clear and accessible methods for contacting the team (such as email or active participation in community forums) are crucial. Their absence may signal a reluctance to engage or hide behind anonymity. Priority: VERY HIGH.

✅ Nice to have: Complete social media, website and contact info. This is usually list on dexscreener.com and other sites.

❌ Infrequent community updates. Regular and consistent updates help maintain trust. If a project rarely communicates progress or important information, it may indicate poor management or an attempt to obscure problems. Priority: HIGH.

❌ Verify Social Media, Influencer, possible hacked account shares address, “CA”. If a well known influencer shares an address (sometimes referred to contract address or CA), verify that it is real and not a hacked account, before taking action. A common scam is to hack an influencers, take it over and then post addresses telling people they buy that coin. Priority: HIGH.

❌ High number of KOLs suddenly promoting. Research X.com to see if they are a high number of Key Online Influencers (KOLs) who may have been paid to promote this. Many shady and scam token pay promoters and the token may not have organic interest because it’s not legitimate. Priority: HIGH.

8. Partnerships and backing

Investigate any claimed partnerships or endorsements with reputable projects, while being cautious of exaggerated claims.

❌ Unverified partnerships. When a project claims partnerships but lacks official statements, verifiable press releases, or links from the purported partners’ channels, it raises serious doubts about the legitimacy of those relationships. Priority: VERY HIGH.

❌ Self-proclaimed endorsements. Relying solely on claims made on the project’s own website or social media without third-party confirmation can indicate that the partnerships might be overstated or fabricated. Priority: HIGH.

❌ Partnerships with obscure entities. If the project is aligned with organizations that have little or no established reputation in the industry, it suggests that these endorsements may be attempts to appear credible without substantive backing. Priority: HIGH.

❌ Inconsistent partnership communication. Frequent changes in partnership claims, or partnerships that appear only during promotional phases and then vanish from official channels, suggest instability and lack of genuine long-term collaboration. Priority: MEDIUM.

❌ Last-minute partnership announcements. If partnerships are announced shortly before or immediately after the token launch, rather than being established well in advance, it can be a tactic to create a false sense of credibility, rather than evidence of solid backing. Priority: VERY HIGH.

9. Roadmap clarity.

Review the project’s roadmap for clear, realistic milestones and achievable goals, since vague plans can be a red flag.

Many memecoins trade on sentiment so will frequently not have a roadmap. But it is a big plus if the project creators have made one, and shows they are serious. Other tokens for apps and with utility should be expected to have a roadmap and vision.

❌ Vague milestones. When the roadmap uses ambiguous language without specific targets or definitions, it becomes difficult to measure progress. Priority: VERY HIGH.

❌ Overly ambitious timelines. Unrealistic deadlines or compressed timeframes may indicate that the team is overpromising and underestimating challenges. Priority: HIGH.

❌ No measurable metrics. A roadmap lacking clear key performance indicators or quantifiable objectives makes it hard to assess the project’s success. Priority: MEDIUM.

10. Utility and use cases.

Understand the token’s purpose and the real-world problems it aims to solve, ensuring it offers genuine value within its ecosystem.

❌ No clear token purpose other than sentiment. When a token lacks a clearly defined purpose or real-world application, it raises doubts about its long-term value and potential beyond speculation. Memecoins are more likely to lack this, and it does not mean they are necessarily a scam solely because they based on sentiment. But more established ones with a plan often have ideas about how they can provide utility that can be integrated into the ecosystem. For example a fan coin may allow you to get into scheduled events or special Zoom forums that require you to own the token. At least they should have some ideas. Priority: HIGH.

❌ Undefined use cases. If the project fails to articulate specific scenarios where the token is needed or beneficial, it may indicate that the token is more about short-term hype than building a community and solving actual problems. Priority: HIGH.

❌ Overly complex justifications. When the token’s utility is explained in unnecessarily technical or convoluted terms that don’t translate into practical benefits, it can be a red flag that the project is masking a lack of genuine use. Look out for people that claim it is too technical for you to understand, and nobody else understands it either. Priority: MEDIUM.

11. Market liquidity.

Assess the token’s liquidity on exchanges, as extremely low liquidity can signal manipulation or a higher risk of exit scams.

❌ Low liquidity on major Solana DEXs. If the token shows very low liquidity on prominent Solana decentralized exchanges such as Raydium or Orca, it may be easy for bad actors to manipulate the price or execute exit scams by quickly moving large orders. For example, if only a few thousand tokens are available for trade compared to established tokens, a small buy or sell order could cause a drastic price swing.

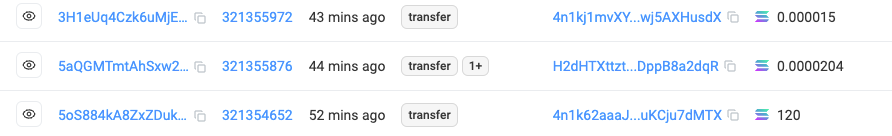

❌ Rapid liquidity withdrawals. A sudden removal or reduction in liquidity — especially if developers can withdraw funds at will — raises concerns that liquidity might be intentionally pulled to trap investors, a common exit scam tactic on decentralized platforms. If a liquidity pool suddenly drops from a high volume to nearly zero in a short period, it suggests that the control over liquidity may be too centralized and unpredictable.

❌ Concentrated liquidity provision. When liquidity is provided predominantly by a few wallets or known entities rather than a broad, diverse group of participants, the token is more vulnerable to coordinated price manipulation and potential rug pulls. If a small handful of addressescontrol most of the trading liquidity, these entities could easily influence the market by executing large trades at strategic times.

❌ Illiquid trading pairs. Pairing the token only with low-stability assets rather than robust pairs like SOL or USDC can lead to high slippage and volatility, signaling that the token may lack genuine market support. If a token is exclusively paired with lesser-known assets, even moderate trades might cause disproportionate changes in price due to the lack of stable countervalue. Additionally, trading pairs that lack reliability and stability tend to discourage broader participation.

❌ Sells and Sell Volume is very high. Check in Dexscreener.com or Dextools.io for the sells and sell volume.

✅ Nice to have: Strong liquidity on major Solana DEXs, locked liquidity to prevent rapid withdrawals, liquidity is contributed by a broad and diverse group of participants, and pairing the token with robust assets such as SOL or USDC. Sell volume is low.

12. Tools

✅ Tokensniffer

Site: “Token Sniffer smart contract scam scanner and its technology are now integrated into Solidus Labs’ Web3 AML solutions. Recently cited by the U.S. Department of the Treasury and in Senate Banking Committee testimonies”

✅ Rugcheck.xyz

Rugcheck.xyz: https://rugcheck.xyz/

This checks a variety of factors to determine if a token is likely to be a rug. Rememember this type of automated analysis is not a 100% guarantee, there are many things it does not check.

✅ Jupiter Trenches with Organic score:

This is not a tool pe se but a rating using Jupiter’s organic formula.

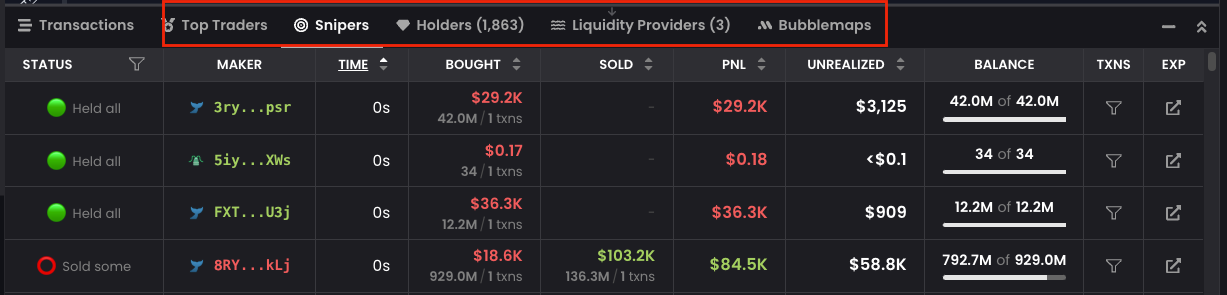

✅ Dexscreener: Audit, Mintable, Freezable, Snipers, Bubblemaps

You can use a variety of tools on Dexscreenr

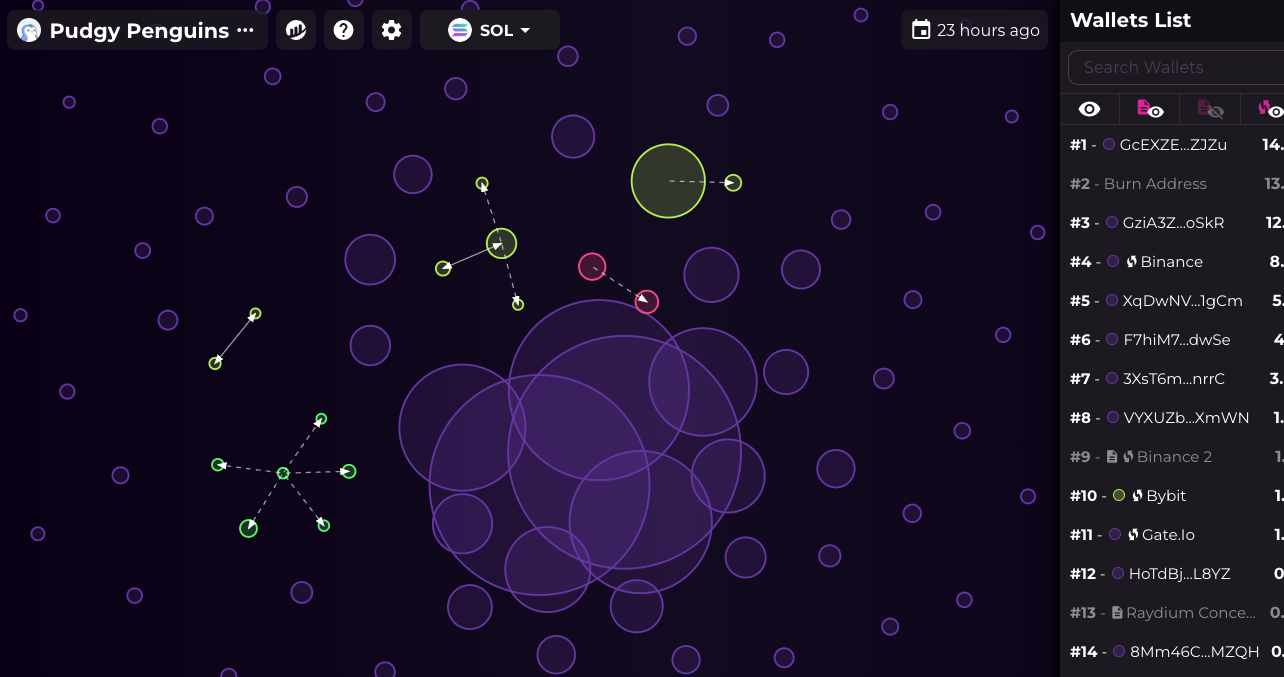

✅ Bubblemaps

Bubblemaps give you a list of the to wallet holders and concentration of wallets. This is also integrated as a tab on Dexscreener.

🥰 Thanks for reading! … 🔥 please clap and share this article, thanks! 🚀

Disclaimer: This article not financial advice. It is a partial, incomplete list of some ideas/methods to research for quality tokens. It’s which meant to be a helpful start only for those interested in learning more about the topic. These alone do not guarantee good token quality or that it is not a scam, and cannot prevent losing money (there are other factors, such as market conditions, other variables, unknowns not covered here). Buy/selling tokens is inherently highly risky, and people often lose all their investment. This is not a recommendation to participate, trade or invest in any token. Only invest money if you can afford the high risk and possibility of losing it.